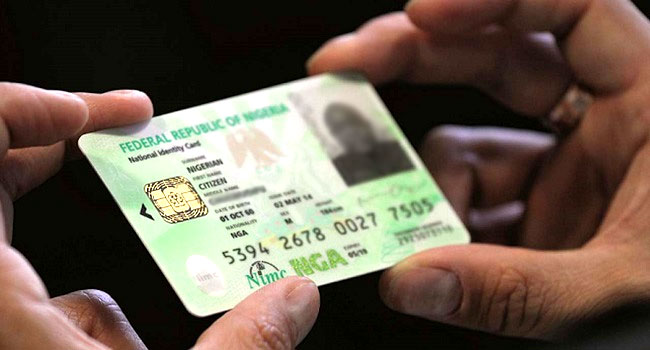

New National ID to Be Unveiled by the FG with Payment and Social Capabilities

An enhanced national identification card with payment capabilities for all social and financial service kinds will be introduced by the federal government through the National Identity Management Commission (NIMC).

The national domestic card scheme AfriGO will power the revolutionary card that was developed in partnership with the CBN and the Nigeria Inter-bank Settlement System (NIBSS).

Kayode Adegoke, head of corporate communications at NIMC, made the announcement on Friday.

A General Multipurpose Card (GMPC) is required to be issued to all citizens and legal residents of Nigeria by the National Identity and Migration Commission (NIMC) under Act No. 23 of 2007. This card is layered with verifiable National Identity characteristics.

Cardholders will be able to verify their identity and have access to public and private social services, as stated by NIMC, because the innovation will meet the demand for physical identification.

Also read: FG Claims That Electricity Tariff Hike Will Only Affect 1.5 Million Customers Across the Country

Additionally, it will empower citizens, promote greater engagement in nation-building, and help disenfranchised Nigerians gain access to financial services.

According to NIMC, in order to apply for the card, one must be a registered citizen or legal resident in possession of a National Identification Number (NIN).

The country’s default national identity card is set to be manufactured in accordance with ICAO requirements. Along with this feature, users can connect their cards to their preferred bank accounts, making them usable as debit or prepaid cards.

Access to various government intervention projects will be made possible for qualified individuals using the card, particularly those who are financially excluded from social and financial services.

The statement stated, in part, that NIMC is “committed to protecting cardholders’ personal data in line with data protection regulation and public interest.” It went on to say that the company will employ security measures that comply with international standards for data security protocols to keep user information private and secure.

The card will have a document number that is in accordance with ICAO requirements, an identification card issuance date, and a machine-readable zone (MRZ) that is in compliance with ICAO for e-passport information.

Among the many additional aspects are those pertaining to transportation, energy subsidies, microloans, agriculture, food stamps, health insurance, and travel.

As the principal means of identity verification through the data stored on the card chip, the card will also have biometric authentication, such as fingerprints and photographs, and Nigeria’s rapid response code (NQR), which contains the national identification number. Transactions can be processed even in locations with spotty or no network access thanks to offline functionality.

The card’s characteristics will include the ability to function as both a debit and prepaid card, making it suitable for persons who are banked and those who are not.

Any commercial bank, NIMC-affiliated agency or agent, or any of its locations around the country would be allowed to process online card requests from citizens and legal residents, according to the organisation.