CBN Stops Foreign Currency As Collateral For Naira Loans

Loans denominated in foreign currency are no longer accepted as collateral by the Central Bank of Nigeria (CBN).

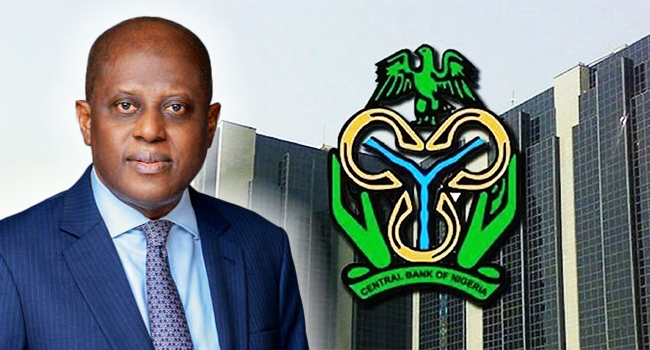

All banks were instructed to do this by Adetona Adedeji, the Acting Director of the Banking Supervision Department at the Central Bank of Nigeria (CBN), in a circular dated April 8, 2024.

Eurobonds issued by the Federal Government or guarantees of foreign banks, including Standby Letters of Credit, are two examples of foreign currency collateral that the top bank official mentioned as an exception to the rule.

“The Central Bank of Nigeria has noted the current situation where bank clients use foreign currency (FCY) as collateral for Naira loans,” the circular partially said.

So, it’s no longer acceptable to use collateral denominated in foreign currency for Naira loans, unless the foreign currency is:

“Eurobonds made by the Nigerian government; or

“International bank guarantees, such as standby letters of credit

“Regarding this matter, it is necessary to liquidate any loans that are currently secured by dollar-denominated collaterals, unless specifically stated otherwise, within 90 days. Failing to do so will result in regulatory penalty, including a risk-weighted 150% for the Capital Adequacy Ratio calculation.”

At the same time, on Monday, the CBN said that it will be selling dollars to more than 1,500 Bureau De Change (BDC) operators in order to satisfy the demand in the retail market for qualified transactions.

One strategy employed by the Central Bank of Nigeria (CBN) to sustain the naira’s advantage against the dollar is the sale of $10,000 to each of the BDCs at a rate of N1,101/$1.

In the past several weeks, the value of the naira has risen relative to the dollar, increasing by more than 40% from its previous level of approximately N1,900/$ to its current level of approximately N1,200/$1.