Recapitalisation: Don’t Make The 2005 Mistakes, Economists Warn CBN

Economists have issued admonitions to the Central Bank of Nigeria (CBN) regarding its intentions to implement a fresh capital base for deposit money banks in Nigeria. They caution the apex bank against repeating certain errors that were made during the previous recapitalization of commercial banks in the nation.

On Monday, both Muda Yusuf, the founder of the Centre for Promotion of Private Enterprise, and Prof. Segun Ajibola of Babcock University in Ogun State, appeared on the Sunrise Daily programme of Channels Television.

Economists concurred that bank recapitalization has become unavoidable, but it must be accomplished so that the bank-impacting mergers and acquisitions do not result in vast layoffs.

“What transpired in 2005 was truly regrettable.” “Banks ought not to be rushed,” Yusuf urged the CBN, adding that banks should be given sufficient time to migrate to the system.

Unlike during the administration of former President Olusegun Obasanjo, he recommended that the apex bank not insist on a brief deadline but rather allow a year or two to complete the process.

Ajibola, for his part, advocated for successful and fluid processes involving stakeholders in strategic consultations, stating that the CBN should not coerce banks into immoral alliances.

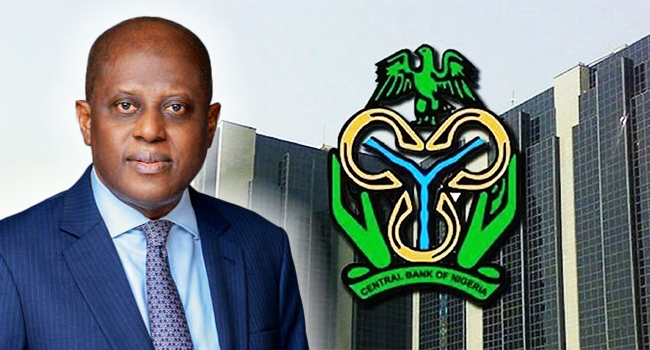

Yemi Cardoso, the head of the CBN, stated last Friday that Nigerian banks lack adequate capital in comparison to the requirements of the financial system to support a $1 trillion economy.

“The Central Bank will initially instruct banks to augment their capital,” he declared at the Chartered Institute of Bankers of Nigeria (CIBN) 60th anniversary celebration in Lagos State.

The last time the CBN increased the capital base of banks was in 2005, during the administration of Charles Soludo, the current governor of Anambra State and the apex bank chief. Capitalization was increased from N2 billion to N25 billion, while an unprecedented season of mergers and acquisitions resulted in the failure of over 80 institutions and the subsequent loss of 30 jobs.