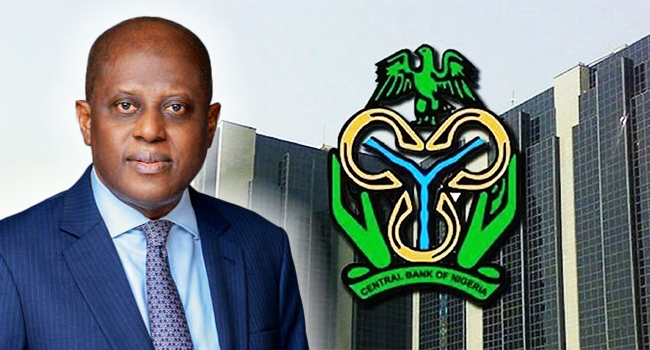

CBN will penalise banks, BDCs for dumping obsolete, small dollar denominations.

Deposit money banks in Nigeria have been issued a warning by the Central Bank of Nigeria to cease the practice of rejecting smaller and older denominations of US dollars.

Rejections would result in fines, according to the CBN.

Bureau de Change personnel and the public were warned to refrain from defacing the notes, according to the document.

On Tuesday, Solaja Mohammed, the acting director of the CBN’s Currency Operations Department, signed a circular that included this warning in connection to COD/DIR/INT/CIR/001/017.

This order was issued because the bank’s customer market data showed that commercial banks and FX traders would not accept older or smaller denominations of US currency.

The acting director cited a circular from 2021 and said that everyone involved must follow the bank’s order, which forbids the practice of selective deposit acceptance.

It said, “Deposit Money Banks and other authorised forex dealers continue to reject old or lower denominations of United States dollar bills.”

Keep in mind that the CBN circular, referred as COD/DIR/INT/CIR/001/002, dated April 9, 2021, which specifically condemned this selective acceptance of deposits, must be followed and complied with by all pertinent parties.

All DMBs and registered forex dealers are now required to accept both lower denominations and older series of legally tender US dollars as deposits from their clients. We are reissuing this circular to ensure strict compliance with this requirement.

If a DMB or authorised currency dealer refuses to take consumers’ lesser denomination or older US dollar bills, the CBN will not hesitate to sanction them.

Also, authorised currency dealers should not deface or stamp US dollar banknotes because doing so will cause the notes to fail authentication tests when they are processed or sorted. Attention: Immediate Compliance Required.

Months after the Economic and Financial Crimes Commission started detaining and prosecuting Nigerians for defacing and mutilating the naira, this development occurs.